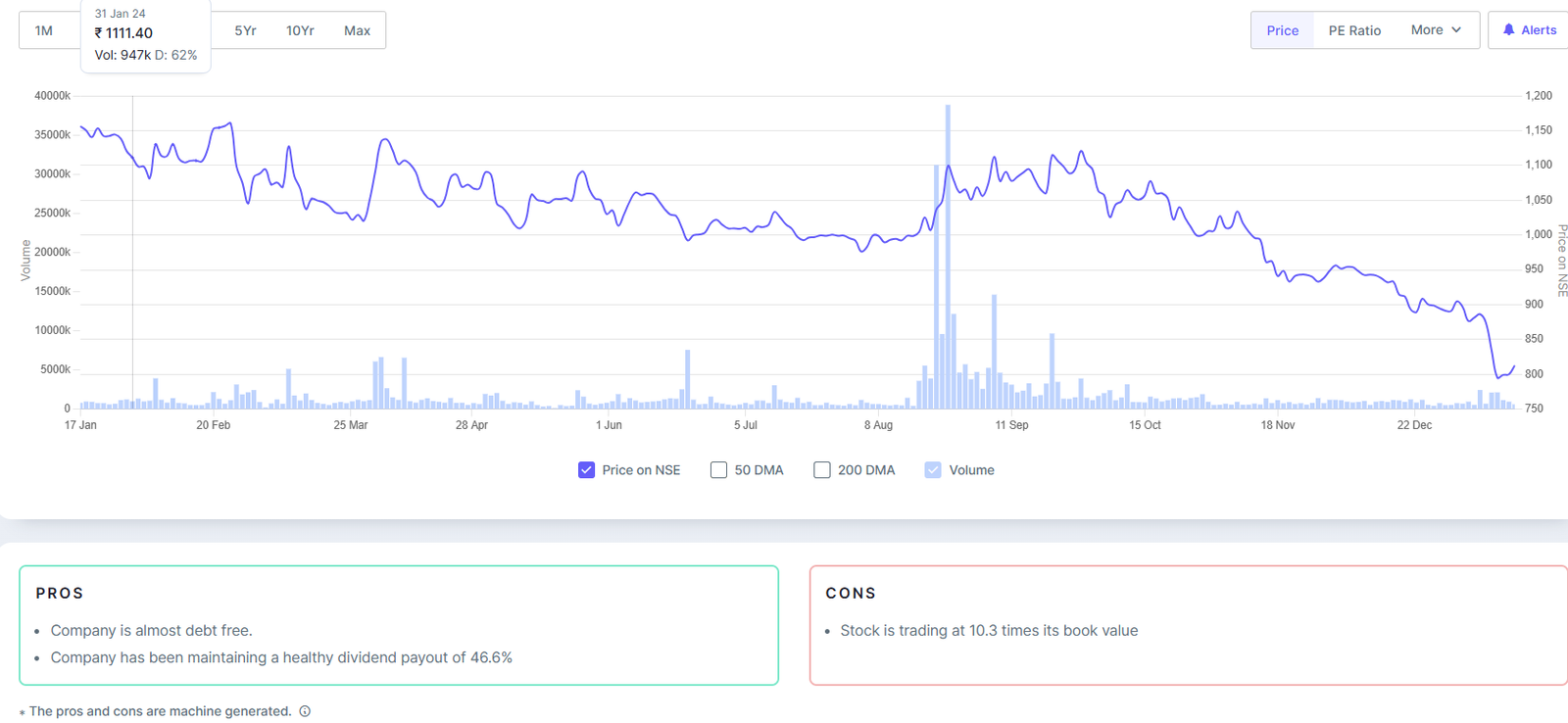

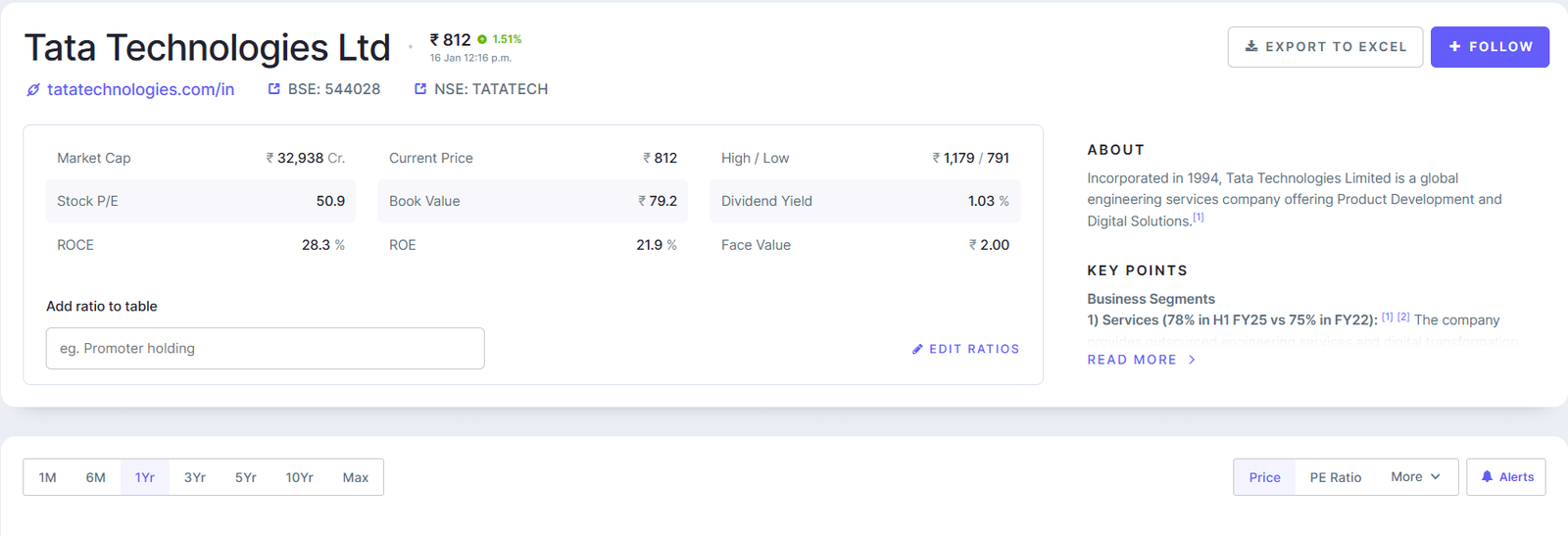

As of January 2025, Tata Technologies Ltd. (TATATECH) is trading at ₹847.fifty-five in step with proportion, marking its 52-week low.

This represents a full-size decline of about 27% over the last year of Tata tech share, contrasting with the Sensex’s 8% increase for the duration of the same duration.

fundamental evaluation of Tata Tech share

return on fairness (ROE)

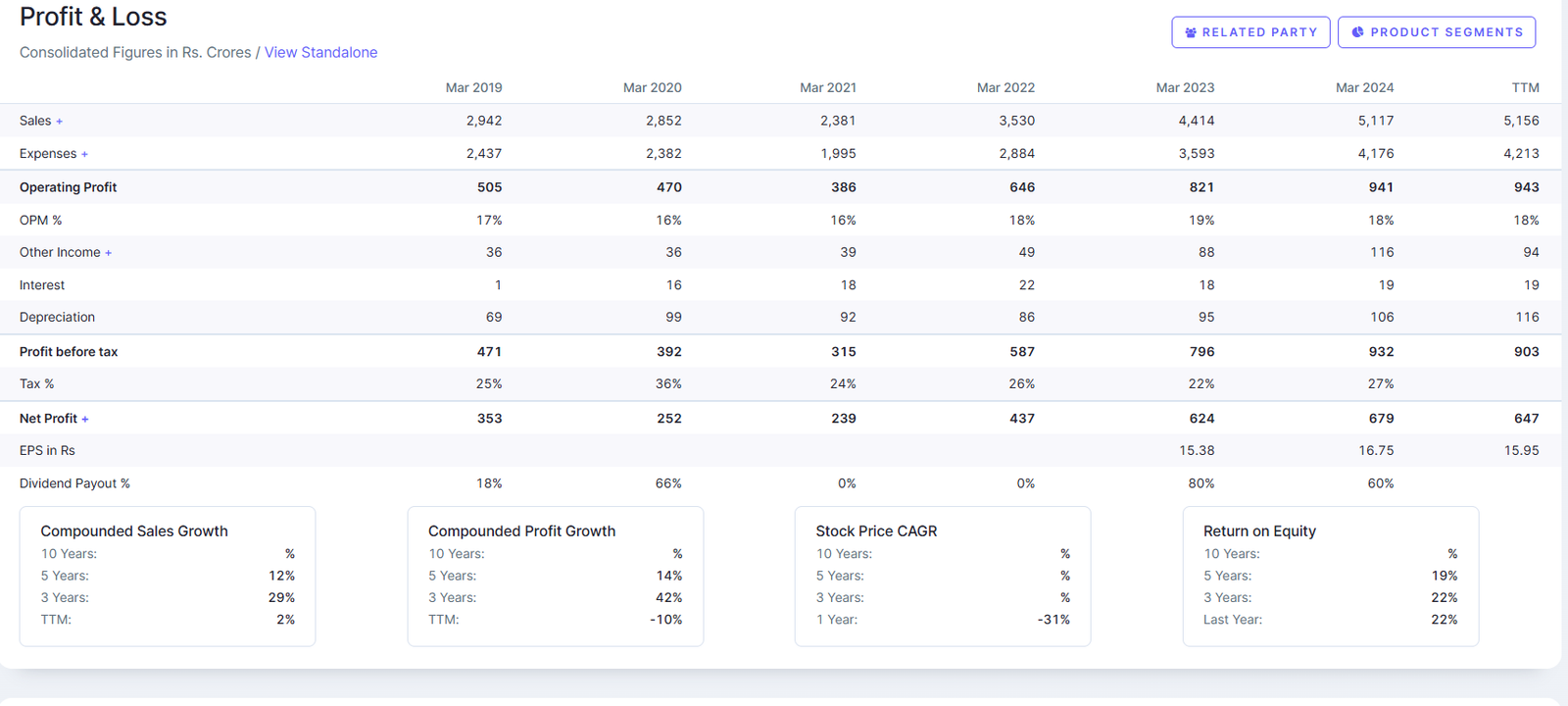

The corporation boasts a robust ROE of sixty-one.98%, demonstrating efficient management and high profitability relative to Tata Tech share shareholders’ fairness.

Debt-to-fairness Ratio

A standout feature of Tata Technology is its debt-unfastened capital shape, which complements its monetary balance and minimizes funding risk.

operating Margin

Technical analysis

brief-time period fashion

Forecasts indicate a capacity decline in the near term, with key help ranges at ₹864 and ₹858.

Analyst suggestions

buy scores

ICICI Securities has issued a ‘buy’ recommendation with a goal fee of ₹1,290, bringing up the corporation’s sturdy capability in electric vehicle (EV) technology, smart manufacturing, and software program-described motors.

sell scores

Conversely, Citi has given the inventory a ‘promote’ score with a target fee of ₹945, expressing worries approximately client dependency dangers, especially with main clients like VinFast.

Recent traits and marketplace Sentiment

The broader IT area is showing signs and symptoms of revival, with groups like Tata Consultancy offerings (TCS) reporting significant consumer interest and deal wins. However, Tata Technologies has no longer mirrored this fashion, possibly due to enterprise-unique demanding situations, such as reliance on some key customers and a capacity slowdown in certain assignment pipelines.

investment concern

at the same time, Tata Technologies demonstrates sturdy basics, including excessive ROE and working margins, present-day technical signs, and mixed analyst opinions that warrant a careful technique. right here are a few key considerations for capacity buyers:

Market Volatility:

The inventory has experienced a 24% decline over the last year, reflecting vast volatility.

Customer Dependency

Heavy reliance on principal clients may pose risks to sales balance, particularly in uncertain marketplace situations.

growth capacity:

The corporation’s focus on EV technology and smart manufacturing aligns with evolving industry developments, presenting long-term growth opportunities.

Conclusion

Tata technology affords a nuanced funding opportunity. On one hand, the employer boasts sturdy economic metrics, operational efficiency, and increased capacity in emerging technology. then again, bearish technical tendencies and blended market sentiment recommend a need for warning.

traders are cautioned to closely reveal the corporation’s overall performance, broader enterprise trends, and key traits in customer relationships before they decide. For people with an extended-term angle, the modern price dip might also provide an attractive entry factor, at the same time as short-term traders ought to anticipate a clean reversal in developments.

Internal link:- a2znew