Ola Electric Mobility Ltd. (Ola Electric), one of India’s most ambitious startups, has recently faced a significant decline in its share price. A stunning 52% drop from its peak has caused concern among investors and market analysts. As the company continues to build its presence in the electric vehicle (EV) sector, the drop in share price has prompted many to assess the company’s prospects. This article aims to provide a thorough analysis of the current situation of Ola Electric share price, examining the factors influencing ola Electric share price decline, a fundamental and technical review, and expert suggestions for potential investors.

1. Overview of Ola Electric share price

Ola Electric was founded in 2017 by Bhavish Aggarwal, the same entrepreneur behind Ola Cabs, a ride-hailing giant. Ola Electric’s goal was to transform India’s electric mobility landscape by manufacturing electric two-wheelers. The company’s mission was not just to produce electric vehicles (EVs) but to accelerate the adoption of sustainable and environmentally friendly transportation solutions in India, which faces one of the highest pollution levels globally.

Ola Electric’s flagship product, the Ola S1, was unveiled in August 2021 and received attention for its aggressive pricing and a variety of innovative features. The company followed up with the launch of the Ola S1 Pro, a premium model, and later, the Ola Roadster series.

The company’s positioning has been clear: become a leader in the Indian EV market, a space that is still growing but faces fierce competition. Ola Electric Share Price initially garnered strong market interest, with Ola Electric share price rising steadily after its public debut. However, recent events have raised red flags for both investors and market analysts.

2. Ola Electric’s Financial Performance and Market Challenges

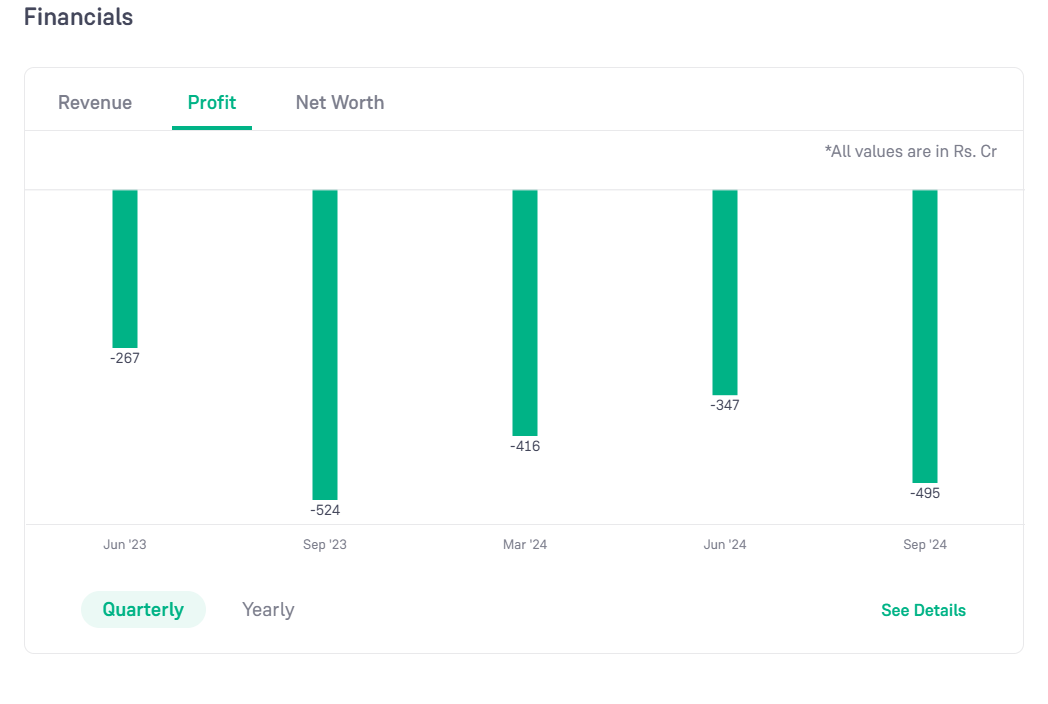

Ola Electric’s financial performance over the past few quarters has been a mix of growth and challenges. In the July-September quarter of 2024, Ola Electric reported a 39% year-on-year increase in operating revenue, reaching ₹1,214 crore. The company’s net loss narrowed to ₹495 crore from ₹524 crore in the same period the previous year. The positive revenue growth was largely driven by an increase in vehicle deliveries, which rose by 73.6% year-on-year, totaling 98,619 units.

However, the company’s profitability remained under pressure. The rising costs of raw materials, which increased by 46.7%, took a toll on its bottom line. Additionally, operational costs such as manufacturing and distribution expenses have weighed heavily on the company’s overall financial health. While revenue is increasing, profitability remains a distant goal.

Investors may have been initially encouraged by the rapid growth in vehicle deliveries, but the company’s path to profitability remains unclear. The electric vehicle market itself is highly competitive, and scaling production while maintaining quality standards is a daunting challenge.

3. Ola Electric’s Stock Price Performance: A Sudden Drop

At its peak, Ola Electric share price touched ₹157.40 in August 2024, buoyed by investor optimism and the company’s initial success. However, in recent months, the stock price has dropped by over 50%, reaching a low of ₹74.41 by January 2025. This drastic drop has caused concern among investors who were once confident in the company’s ability to lead the EV revolution in India.

Several factors have contributed to this decline, with both internal and external factors affecting investor sentiment. Let’s explore the major reasons behind the drop in Ola Electric share price.

3.1 Customer Service Challenges and Backlash

Ola Electric’s customer service has become a significant point of contention in recent months. According to reports, the company has faced over 10,000 customer complaints within just one year. These complaints ranged from delayed services, poor after-sales support, unsatisfactory service quality, and issues with inaccurate invoices.

A few customers reported poor handling of issues related to charging infrastructure, warranty claims, and even the vehicle’s quality and reliability. The central government’s consumer protection body, the Central Consumer Protection Authority (CCPA), issued a notice to Ola Electric, asking the company to explain the rise in consumer complaints and take corrective actions.

The company’s failure to effectively address customer service issues and resolve complaints promptly has damaged its reputation. A negative customer experience directly impacts brand loyalty, sales, and long-term prospects. Given that Ola Electric has positioned itself as a premium EV brand, customer service quality is critical to its success. The lack of attention to these issues has created a significant trust deficit, negatively affecting the company’s share price.

3.2 Regulatory Scrutiny and Corporate Governance Issues

In addition to customer service problems, Ola Electric share price has found itself under regulatory scrutiny. The Securities and Exchange Board of India (SEBI) issued a warning to the company for failing to disclose certain information to investors promptly. Specifically, Ola Electric shared company-related information on social media platforms before officially informing investors through the appropriate channels, which is a violation of fair disclosure regulations.

Such regulatory issues create an atmosphere of uncertainty. Investors prefer transparency, and any signs of mismanagement or failure to adhere to corporate governance practices can lead to a loss of confidence. For a company that is trying to expand its market share, regulatory scrutiny can significantly hamper its growth prospects.

3.3 Executive Departures and Leadership Instability

Leadership instability is another critical factor contributing to the decline in Ola Electric share price. Several key executives have resigned over the past year, including the Chief Technology Officer and Chief Marketing Officer, citing personal reasons. These departures have raised concerns about the company’s ability to execute its long-term vision and strategy effectively.

The resignation of high-level executives, particularly those responsible for key functions such as technology and marketing, signals potential internal challenges. These changes can disrupt day-to-day operations and may have a lasting impact on the company’s future direction. For investors, leadership changes can raise questions about the company’s ability to sustain growth, innovation, and competitive advantage.

3.4 Increased Competition in the EV Market

Ola Electric has also been facing increased competition in the electric vehicle market. Competitors such as TVS Motor, Hero MotoCorp, and Bajaj Auto are making strides in the EV space, launching electric scooters that have gained significant market share.

TVS Motor’s iQube and Bajaj Auto’s Chetak have captured a growing portion of the EV market, forcing Ola Electric to reassess its market position. These companies have a long-standing presence in the Indian automobile market and are leveraging their established brand value to promote their electric models.

While Ola Electric is aggressively marketing its products, it faces stiff competition from these players, who have already established a strong foothold in the traditional two-wheeler market. The increasing competition is putting pressure on Ola Electric’s market share, and this is reflected in the declining stock price.

4. Frequently Asked Questions (FAQs)

1. Why has Ola Electric’s share price dropped by 52%?

Ola Electric’s share price has dropped by 52% due to a combination of internal and external factors. These include issues with customer service, regulatory scrutiny, executive departures, increased competition from other EV makers, and investor sentiment turning negative due to these challenges.

2. What are the key challenges faced by Ola Electric?

Ola Electric faces several challenges:

- Customer service issues, with over 10,000 complaints registered.

- Regulatory scrutiny from the Securities and Exchange Board of India (SEBI) for not adhering to fair disclosure practices.

- Leadership instability, with the resignation of key executives like the Chief Marketing Officer and Chief Technology Officer.

- Intensifying competition from established EV players such as TVS Motor, Bajaj Auto, and Hero MotoCorp.

3. Is Ola Electric a good investment right now?

While Ola Electric has a solid presence in the Indian EV market, investors should exercise caution. The company faces operational challenges, including poor customer service and leadership turnover. Moreover, the EV market is becoming increasingly competitive, which could impact Ola Electric’s growth. Investors should carefully consider these factors and consult financial advisors before making investment decisions.

4. What is Ola Electric’s market position in India?

Ola Electric is one of the leading manufacturers of electric scooters in India. However, its market share has been threatened by competitors like TVS Motor’s iQube and Bajaj Auto’s Chetak. While Ola Electric is still a significant player, the increasing competition is posing challenges to its dominance in the market.

5. How has Ola Electric’s financial performance been recent?

In its latest financial report for the July-September 2024 quarter, Ola Electric reported a 39% increase in operating revenue, totaling ₹1,214 crore. However, the company still posted a net loss of ₹495 crore, which narrowed slightly compared to the previous year. Rising raw material costs and operational expenses have put pressure on the company’s profitability despite the increase in vehicle deliveries.

6. Can Ola Electric share price recover from this share price decline?

Ola Electric’s recovery largely depends on how effectively the company addresses its operational challenges. If it can improve customer service, adhere to regulatory standards, stabilize its leadership team, and differentiate itself from competitors, it may regain investor confidence. However, investors should remain cautious and monitor any strategic changes closely.

5. Key Takeaways: A Summary of Ola Electric share price Current Situation

Below is a summary of key data and points related to Ola Electric, including financial details, competitive landscape, and investor outlook:

| Aspect | Details | Implications |

|---|---|---|

| Stock Price Performance | The stock price has fallen by 52% from its peak of ₹157.40 to ₹74.41. | This indicates a significant loss of investor confidence and market skepticism. |

| Revenue | ₹1,214 crore in the July-September 2024 quarter, a 39% YoY increase. | Revenue growth indicates increasing sales but not necessarily profitability. |

| Net Loss | Net loss of ₹495 crore, slightly improved from ₹524 crore in the previous year. | The company’s path to profitability remains uncertain despite revenue growth. |

| Customer Complaints | Warned by SEBI for failing to disclose information promptly. | This reflects poor customer service and is a potential long-term issue. |

| Regulatory Issues | Warned by SEBI for failing to disclose information in a timely manner. | Legal and regulatory challenges could delay progress and investor trust. |

| Executive Departures | Key executives such as the CTO and CMO have resigned. | Leadership changes could impact the company’s direction and strategy. |

| Competition | Increased competition from TVS Motor, Bajaj Auto, and Hero MotoCorp. | Intensified competition could limit Ola Electric’s growth potential. |

| Customer Service | Issues with vehicle quality, charging infrastructure, and after-sales support. | Customer service is a critical aspect that needs improvement for long-term success. |

6. Conclusion: The Road Ahead for Ola Electric

Ola Electric’s journey has been marked by both impressive growth and significant challenges. The company has shown promise in terms of revenue growth, vehicle deliveries, and establishing a strong brand in India’s burgeoning electric vehicle market. However, the dramatic drop in share price highlights the operational difficulties and the competitive pressure it faces.

For Ola Electric to regain investor confidence and recover its market value, the company must address several critical issues:

- Improving customer service and addressing the backlog of complaints.

- Ensuring transparency and regulatory compliance, particularly with SEBI.

- Stabilizing leadership, ensuring the company’s direction is clear and consistent.

- Innovating and differentiating in a market that is becoming crowded with competitors.

Given the volatility in the stock price, potential investors should weigh the risks carefully. The EV sector holds immense promise, but it is still in its nascent stages. Ola Electric’s ability to innovate, adapt to challenges, and maintain customer satisfaction will ultimately determine whether it can thrive in the long term.

While the company is facing significant headwinds, its commitment to sustainable mobility and the rapidly growing EV market in India mean it still holds potential for the future. However, as with any investment in the tech or automotive sectors, a cautious and well-informed approach is key.

4. Frequently Asked Questions (FAQs)

1. Why has Ola Electric share price dropped by 52%?

Ola Electric’s share price has dropped by 52% due to a combination of internal and external factors. These include issues with customer service, regulatory scrutiny, executive departures, increased competition from other EV makers, and investor sentiment turning negative due to these challenges.

2. What are the key challenges faced by Ola Electric?

Ola Electric faces several challenges:

- Customer service issues, with over 10,000 complaints registered.

- Regulatory scrutiny from the Securities and Exchange Board of India (SEBI) for not adhering to fair disclosure practices.

- Leadership instability, with the resignation of key executives like the Chief Marketing Officer and Chief Technology Officer.

- Intensifying competition from established EV players such as TVS Motor, Bajaj Auto, and Hero MotoCorp.

3. Is Ola Electric a good investment right now?

While Ola Electric has a solid presence in the Indian EV market, investors should exercise caution. The company faces operational challenges, including poor customer service and leadership turnover. Moreover, the EV market is becoming increasingly competitive, which could impact Ola Electric’s growth. Investors should carefully consider these factors and consult financial advisors before making investment decisions.

4. What is Ola Electric’s market position in India?

Ola Electric is one of the leading manufacturers of electric scooters in India. However, its market share has been threatened by competitors like TVS Motor’s iQube and Bajaj Auto’s Chetak. While Ola Electric is still a significant player, the increasing competition is posing challenges to its dominance in the market.

5. How has Ola Electric’s financial performance been recent?

In its latest financial report for the July-September 2024 quarter, Ola Electric reported a 39% increase in operating revenue, totaling ₹1,214 crore. However, the company still posted a net loss of ₹495 crore, which narrowed slightly compared to the previous year. Rising raw material costs and operational expenses have put pressure on the company’s profitability despite the increase in vehicle deliveries.

6. Can Ola Electric recover from this share price decline?

Ola Electric’s recovery largely depends on how effectively the company addresses its operational challenges. If it can improve customer service, adhere to regulatory standards, stabilize its leadership team, and differentiate itself from competitors, it may regain investor confidence. However, investors should remain cautious and monitor any strategic changes closely.

5. Key Takeaways: A Summary of Ola Electric share price Current Situation

Below is a summary of key data and points related to Ola Electric, including financial details, competitive landscape, and investor outlook:

| Aspect | Details | Implications |

|---|---|---|

| Stock Price Performance | The stock price has fallen by 52% from its peak of ₹157.40 to ₹74.41. | This indicates a significant loss of investor confidence and market skepticism. |

| Revenue | ₹1,214 crore in the July-September 2024 quarter, a 39% YoY increase. | Revenue growth indicates increasing sales but not necessarily profitability. |

| Net Loss | Net loss of ₹495 crore, slightly improved from ₹524 crore in the previous year. | The company’s path to profitability remains uncertain despite revenue growth. |

| Customer Complaints | Over 10,000 complaints registered within a year. | This reflects poor customer service and is a potential long-term issue. |

| Regulatory Issues | Over 10,000 complaints were registered within a year. | Legal and regulatory challenges could delay progress and investor trust. |

| Executive Departures | Key executives such as the CTO and CMO have resigned. | Leadership changes could impact the company’s direction and strategy. |

| Competition | Increased competition from TVS Motor, Bajaj Auto, and Hero MotoCorp. | Intensified competition could limit Ola Electric’s growth potential. |

| Customer Service | Issues with vehicle quality, charging infrastructure, and after-sales support. | Customer service is a critical aspect that needs improvement for long-term success. |

6. Conclusion: The Road Ahead for Ola Electric

Ola Electric’s journey has been marked by both impressive growth and significant challenges. The company has shown promise in terms of revenue growth, vehicle deliveries, and establishing a strong brand in India’s burgeoning electric vehicle market. However, the dramatic drop in share price highlights the operational difficulties and the competitive pressure it faces.

For Ola Electric to regain investor confidence and recover its market value, the company must address several critical issues:

- Improving customer service and addressing the backlog of complaints.

- Ensuring transparency and regulatory compliance, particularly with SEBI.

- Stabilizing leadership, ensuring the company’s direction is clear and consistent.

- Innovating and differentiating in a market that is becoming crowded with competitors.

Given the volatility in the stock price, potential investors should weigh the risks carefully. The EV sector holds immense promise, but it is still in its nascent stages. Ola Electric share price ability to innovate, adapt to challenges, and maintain customer satisfaction will ultimately determine whether it can thrive in the long term.

While the company is facing significant headwinds, its commitment to sustainable mobility and the rapidly growing EV market in India means it still holds potential for the future. However, as with any investment in the tech or automotive sectors, a cautious and well-informed approach is key.