🚆 Introduction: Understanding RVNL’s Market Position

RVNL Share Price is a leading public sector enterprise under the Ministry of Railways in India, specializing in rail infrastructure development. Given its significant role in the railway sector, RVNL has garnered the attention of investors looking for long-term value in infrastructure and government-backed projects. In this article, we provide a detailed analysis of RVNL share price, expert recommendations, and technical insights to help investors make informed decisions.

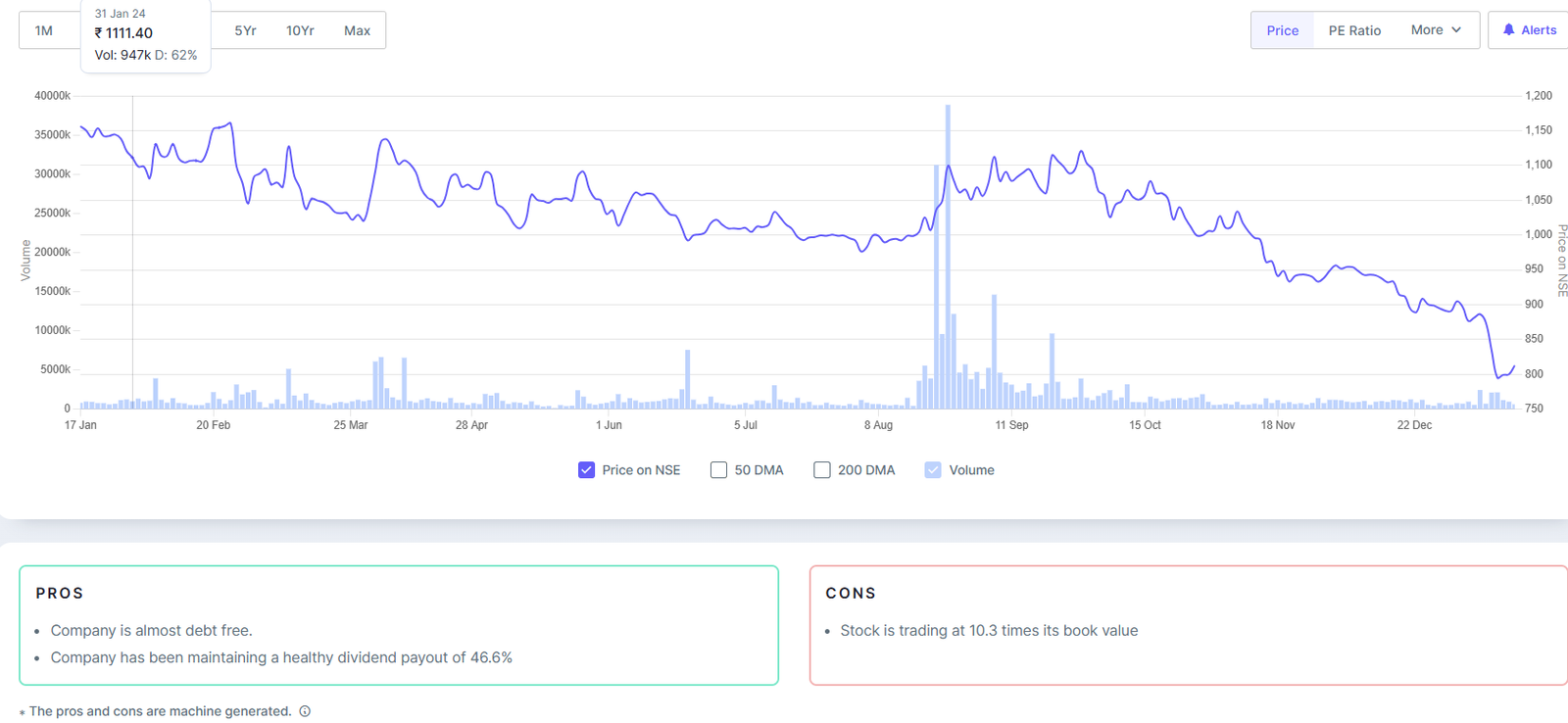

📈 RVNL Share Price Performance

🔹 Current Market Price

As of the latest available data, RVNL’s share price stands at ₹476.30.

🔹 52-Week High & Low

- 52-Week High: ₹647.00

- 52-Week Low: ₹213.05

🔹 Recent Performance Trends

- Over the last six months, the stock has declined by approximately 27.92%.

- The stock has witnessed fluctuations, with bullish momentum in some trading sessions.

📊 Source: Economic Times

🏦 Expert Recommendations on RVNL Stock

🔹 MarketScreener

- Consensus Rating: “Underperform”

- Target Price: ₹357.00

- Potential Downside: -25.05%

🔗 Source: MarketScreener

🔹 Trendlyne

- Average Target Price: ₹463.00

- Potential Downside: Slight decline from the current price.

🔗 Source: Trendlyne

🔹 Alpha Spread

- 1-Year Target Price: ₹364.14

- Estimated Range: ₹253.51 – ₹486.15

🔗 Source: Alpha Spread

🔹 Axis Securities

- Recommendation: BUY (on dips)

- Target Price: ₹501.00

- Reasoning: Strong order book, robust financials, and a clean balance sheet.

🔗 Source: ET Now

📊 Technical Analysis of RVNL Stock

🔹 Moving Average & MACD Indicators

- MACD (Moving Average Convergence Divergence) suggests bullish momentum, with the fast MACD line crossing above the slow signal line.

- Trading volume and quarterly price action indicate upper-range positioning.

🔗 Source: Munafa Sutra

🔹 Key Support & Resistance Levels

- Support Level: ₹450

- Resistance Level: ₹500 – ₹520

- If the stock breaks above ₹520, it may trigger a strong upside movement.

📉 Financial Challenges & Performance Insights

🔹 Recent Q1 2024 Earnings Report

- Net Profit Decline: 35% drop in net profit for Q1 2024.

- Revenue Growth: Moderate revenue increase but higher expenses impacted profit margins.

📌 Expert Verdict: Despite short-term challenges, RVNL remains a strong bet for long-term investors due to its government-backed projects and strong financial fundamentals.

🔗 Source: ET Now

💡 Conclusion: Should You Invest in RVNL?

✅ Reasons to Buy RVNL Stock

✔️ Government-backed projects ensure stability.

✔️ Strong order book with future growth potential.

✔️ Expert recommendations suggest a BUY-on-dips strategy.

✔️ MACD and technical indicators show bullish potential in upcoming months.

❌ Potential Risks to Consider

⚠️ Recent decline in net profits.

⚠️ Short-term volatility in stock price.

⚠️ Analysts predict a possible downside if financials weaken further.

🔥 Final Verdict

- Long-term investors can consider accumulating RVNL stock on dips.

- Short-term traders should monitor technical resistance levels at ₹500-₹520 before making any moves.

- Always perform your own research and risk assessment before investing.

📌 Disclaimer: Stock investments involve risks. Consult a financial advisor before making investment decisions.

🚀 Stay updated with the latest stock insights! Follow expert recommendations and track RVNL’s stock for the best opportunities.

Internal link:- a2znew